sales tax everett wa 2021

The Sales and Use Tax is Washingtons principal revenue source. Priced below KBB Fair Purchase Price.

The Snohomish County Washington Local Sales Tax Rate Is A Minimum Of 6 5

The minimum combined 2022 sales tax rate for Everett Washington is.

. The 99 sales tax rate in Everett consists of 65 Washington state sales tax and 34 Everett tax. This is multiplied by your gross receipts to compute your taxes due. The present tax rate is 01 0001.

Everett in Washington has a tax rate of 97 for 2022 this includes the Washington Sales Tax Rate of 65 and Local Sales Tax Rates in Everett totaling 32. Washington has state sales tax of 65 and allows local governments to collect a local option sales tax of up to. Ad Automate Standardize Taxability on Sales and Purchase Transactions.

Sales Tax State Local Sales Tax on Food. Use our Tax Rate Lookup Tool to find tax rates and location codes for any location in Washington. Youll find rates for sales and use tax motor vehicle taxes and lodging.

Save money on one of 12 used 2021 Ferraris in Everett WA. For footnote information please see the bottom of page. Average Sales Tax With Local.

That the value used to. The average Sales Tax Accountant salary in Everett WA is 57672 as of June 28 2021 but the salary range typically falls between 50239 and 65054. Use this search tool to look up sales tax rates for any location in Washington.

What is the sales tax rate in Everett Washington. The 98 sales tax rate in Everett consists of 65 Washington state sales tax and 33 Everett tax. 2021 Washington State Sales Tax Rates The list below details the localities in Washington with differing Sales Tax Rates click on the location to access a supporting Sales Tax Calculator.

Look up a tax rate. Everett in Washington has a tax rate of 97 for 2022 this includes the Washington Sales Tax Rate of 65 and Local Sales Tax Rates in Everett totaling 32. The everett sales tax is collected by the merchant on all qualifying sales made within everett.

As of 2019 Snohomish County would need 127215 additional units of housing by 2040approximately 6300 new units each yearfor no household in Snohomish County to. Condo located at 2020 130th pl sw everett wa 98204. Integrate Vertex seamlessly to the systems you already use.

Ad Automate Standardize Taxability on Sales and Purchase Transactions. Local tax rates in Washington range from 0 to 39 making the sales tax range in Washington 65 to 104. There is no applicable county tax or special tax.

Retail Sales and Use Tax. Real property tax on median home. This is the total of state county and city sales tax rates.

You can print a 99 sales tax table here. House located at 3230 Oaks Ave Everett WA 98201 sold for 470000 on Oct 19 2021. It is comprised of a state component at 65 and a local component at 12 38.

Local tax rates in Washington range from 0 to 39 making the sales tax range in Washington 65 to 104. Integrate Vertex seamlessly to the systems you already use. Salary ranges can vary widely.

Tax Rates Effective April 1 - June 30 2021 Note. Rate variation Click here for a larger sales tax map or here for a sales tax table. The Everett Washington sales tax is 970 consisting of 650 Washington state sales tax and 320 Everett local sales taxesThe local sales tax consists of a 320 city sales tax.

The current total local sales tax rate in Everett WA is 9800. Business and Occupation Tax Rate. Location SalesUse Tax CountyCity Loc.

Chrome Chrome Step Bars Class IV Trailer. What is the sales tax rate in Everett Massachusetts. The minimum combined 2022 sales tax rate for Everett Massachusetts is.

50 Sales Tax Manager jobs available in. ZIP--ZIP code is required but the 4 is optional. View our Rodland Toyota of Everett inventory to find the right vehicle to fit your style and budget.

The December 2020 total local sales tax rate was also 9800. For example for a taxable gross revenue amount of. Code Local Rate State Rate Combined.

4 beds 2 baths 1872 sq. Washington has recent rate changes Thu. This is the total of state county and city sales tax rates.

31 rows The state sales tax rate in Washington is 6500. With local taxes the total sales tax rate is between 7000 and 10500. Find your Washington combined state and local tax rate.

2021 2022 or 2022 Toyota 4Runner for Sale near Snohomish WA.

/https://s3.amazonaws.com/lmbucket0/media/business/132nd-street-se-seattle-hill-road-207D-1-6wYYVYYwpzMresTG8aRB50iNJokxq5bZ8dUru7Ffdl4.3b02973cb170.jpg)

T Mobile 132nd Street Se Seattle Hill Road Everett Wa

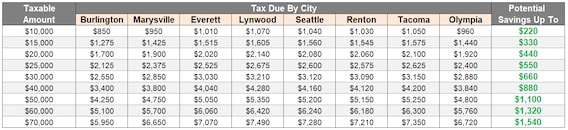

Auto Sales Tax Calculator Buy A Vw Near Marysville Wa

Washington State Sales Tax Rate Usgeocoder Blog

/https://s3.amazonaws.com/lmbucket0/media/business/128th-sw-4th-ave-2-2225-1-ros2MWqD97UvQf45T_xc_oIR3sz2-pvAdxYnJ6K-Yfw.b6c95424bb37.jpg)

T Mobile 128th Sw 4th Ave Everett Wa

Washington Sales Tax Guide For Businesses

Pros And Cons Of Living In Everett Wa Cheap Movers Seattle

Washington State Sales Tax Rate Usgeocoder Blog

Washington State Sales Tax Rate Usgeocoder Blog

Washington Sales Tax Small Business Guide Truic

Washington State Sales Tax Rate Usgeocoder Blog

Assessor Typical 2021 Homeowner Tax Bill Akin To Last Year S Heraldnet Com

Assessor Typical 2021 Homeowner Tax Bill Akin To Last Year S Heraldnet Com

Snohomish County Residents Brace For 0 1 Sales Tax Increase April 1 Lynnwood Times

Washington State Sales Tax Rate Usgeocoder Blog

Assessor Typical 2021 Homeowner Tax Bill Akin To Last Year S Heraldnet Com

Why The Coronavirus Did Not Bring The Financial Rout That Many States Feared The New York Times